How does Equipment Leasing Work?

Equipment leasing allows clients to acquire an asset without effecting their debt-to-income ratio and less initial cash input, while also providing the benefit of tax deductions.

Easy-To-Use Leasing Forms

- Fast & Easy Process (typically a response within 24 hours following a complete submission of the application requirements)

- Application process establishes a pre-approval

- For New & Used Pieces of Equipment (Any Brand)

- Contact Your LSI Rep. & They Will Take Care of the Details

- Complete Application Includes

- Online or PDF Application

- Financial Statement

- Previous Two-Years of Tax Returns

- Valid Driver’s License

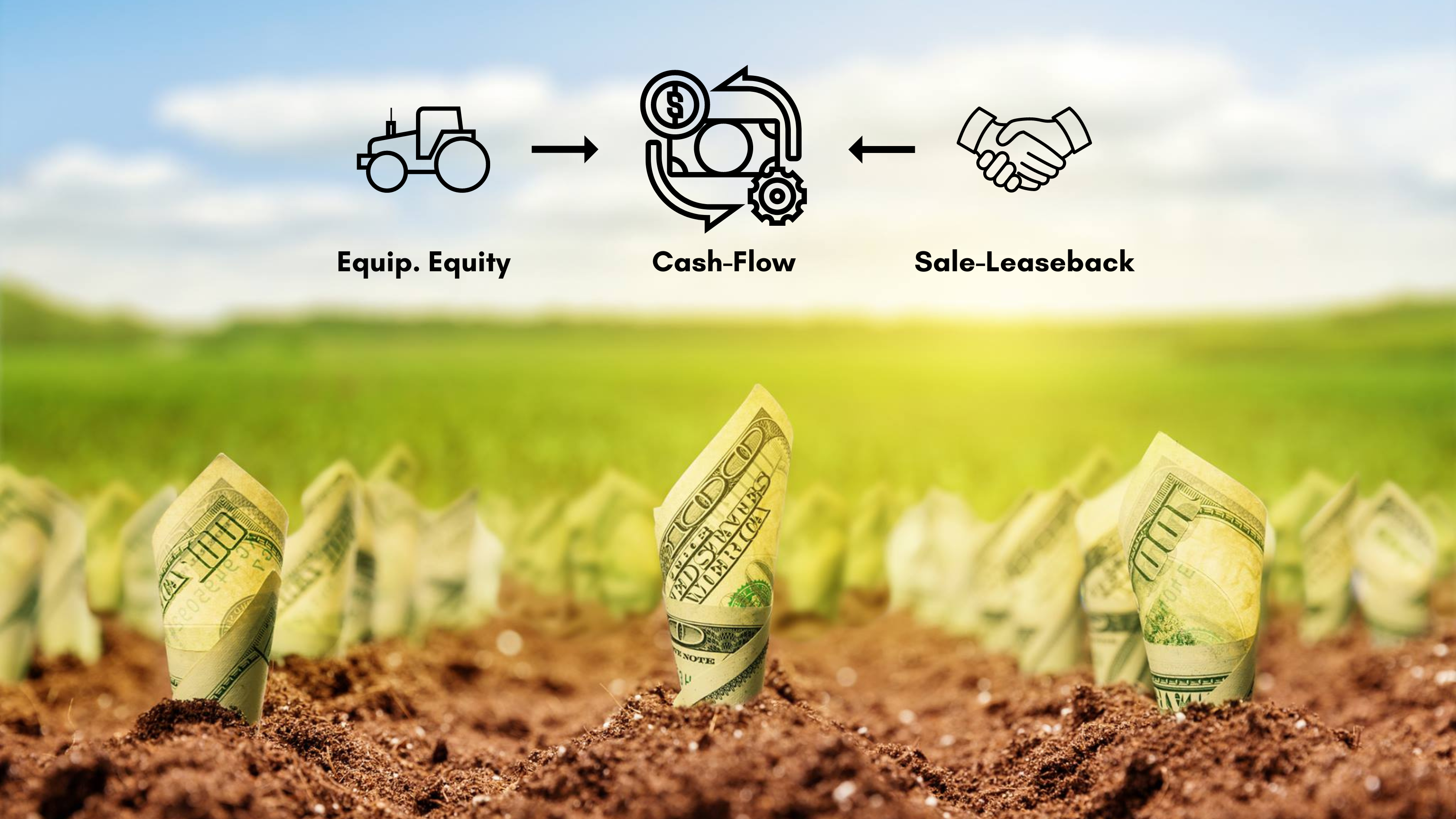

Sale-Leaseback

- LSI will purchase your equipment and lend a percentage of the equipment’s Fair Market Value back to you

- The lending percentage is determined case-by-case

- Your LSI Representative will work with you on determining the best way to structure the leaseback to fit your goals

- Flexible residual options are offered

- All Sale-Leasebacks require the application information listed above

- Call or Contact Today!

LSI Equipment Leasing Options

True Tax Lease (Operational Lease)

The True Tax Lease is a traditional operational lease that LSI has proudly offered for nearly five decades. This option provides significant tax advantages and balance sheet benefits for our customers.

Finance Lease Agreement ($1.00 Buyout Lease)

The Finance Lease Agreement, also known as the $1.00 Buyout Lease, is a more recent addition to LSI’s offerings. This option expands the range of equipment we can lease and is especially suited for assets like trucks, trailers, or grain bins that involve titles or mortgages.

Get To Know More About LSI Equipment Leasing

Leasing allows you to upgrade to newer equipment more frequently as new technologies emerge. With a lease, you’re not stuck with the same equipment for years.

Manage Cash Flow

Leasing spreads equipment costs over time into more manageable monthly payments instead of a large lump sum purchase price. This can help better manage cash flow.

Lower Upfront Costs

Leasing requires less money upfront compared to financing or purchasing equipment outright. This frees up capital for other investments.

Flexible Terms

Leases can be structured with flexible payment and duration terms to meet your specific operating requirements.

Farm Equipment Planning

More reasons to lease equipment with LSI

How Does LSI Work?

LSI provides both a “True Tax Lease” and a “Finance lease, which allows flexibility for more lease options.

Optimize Your Taxes!

A “True Tax Lease” is considered an operating expense, like a rental expense. The total yearly payments due can be applied toward tax deductions.

How does leasing help my equity?

In a Sale-Leaseback, LSI will purchase your equipment and then lease it back to you, if the equipment has a verifiable secondary market.

What Else Should I Know about Equipment Leasing?

If you have anymore questions about Equipment Leasing, go ahead and contact LSI right now!

Ready to start leasing equipment?

Discover the best in Farm Equipment

Contact LSI

2701 Grand Ave, Galesburg, IL 61401

(309) 343-2099